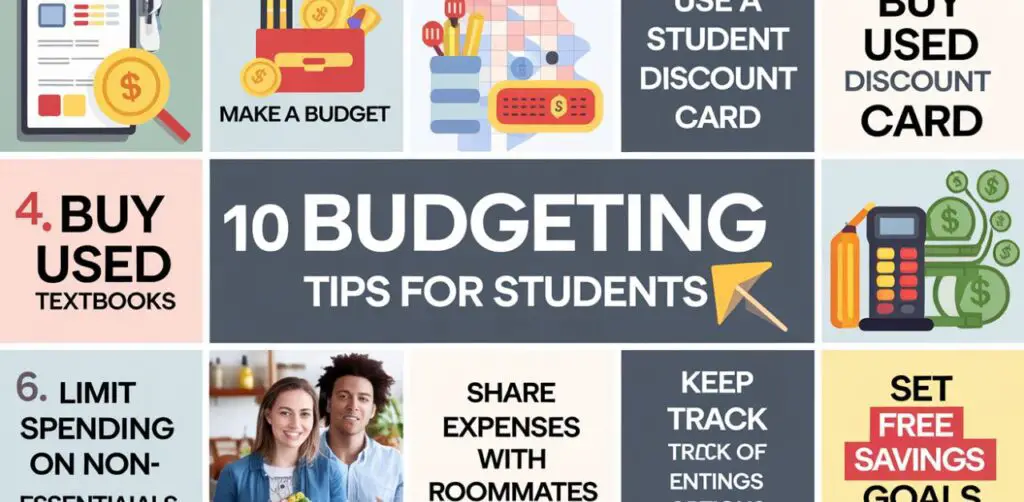

Do you have student debt? Are books, tuition, and rent vying for your dwindling dollars? Just believe me for a moment. How can you follow 10 Essential Budget Tips Every Student Should Know to enjoy the college experience without breaking the bank?

The answer lies in mastering the art of budgeting. It is only through learning to budget well that you can manage your expenses today and also open avenues to financial success tomorrow. Whether your financial situation is amongst the better or one of the worst, budgeting is a tool through which you can ensure maximum utilization of your money.

But this article will give you several steps on how to stretch more from your money aside from teaching you to be careful with your allowance or working part-time. That’s because these insights that fill the pages of this article are going to be surely helpful for you: like the 10 Essential Budget Tips Every Student Should Know, will empower you to take control of your finances with confidence.

Table of Contents

1. Create a Detailed Budget

You will find some crucial budgeting tips that will guide you through the process of managing your finances and enjoying your college days. Here is an expert’s guide to providing you with some of the most trustworthy information specifically tailored for students on a tight budget. Get started today and take charge confidently of your financial future!

Understand Your Income and Expenses

- Track Sources of Income: This includes a record of all the money you’re bringing home, whether it’s a part-time job or scholarship. This is how you know exactly what you have to work with each month.

- List All Expenses: Break down your spending into fixed and variable costs. This can help you spot areas that you might save on or adjust spending in.

- Set Financial Goals: If it’s to save for a trip, or to pay for a debt, clear goals motivate the process. Budgeting feels rewarding and not like a chore.

2. Use Budgeting Tools

College students should remain fiscally responsible, and the art of budgeting is your blueprint for success in college. Use these expert budget tips to move forward with a handle on your money and dispel stress. Start today and enjoy your college experience while securing your financial future.

Leverage Technology

- Budgeting Apps: Try out apps such as Mint or YNAB that are easy to use; keep track of where your money is going, while managing your finances becomes a breeze.

- Spreadsheets: Budgeting with Spreadsheets If you like hands-on approaches, you can make a budget spreadsheet and track where your money is going and what’s coming in.

- Set Financial Goals: It’s easy to create clear goals; whether you are saving for a trip or paying off debt, these are good motivations to keep to your budget.

3. Prioritize Needs Over Wants

Discover the skills of managing a budget that every student must have to be successful in college. Learn how you can allocate your money wisely with expert tips fitting into a limited budget. Take control of your finances today, and have peace of mind for the rest of your college years.

Make Smart Spending Decisions

- Prioritize Necessities: Use those sweets only when you already spent for other things such as your rent, grocery, or fare in going to work. When you know what your priorities are, you’d be able to handle your budget rightly.

- Evaluate Your Purchases: Ask yourself if a product is something that you really need or just one of those impulsive wants. That little check can save you from impulse buys!

- Conscious Choices: Spend in step with your fiscal goals. A bit of planning goes a long way in keeping a wallet healthy!

4. Plan Meals and Grocery Shopping

Tired of the college budgeting game? Don’t worry-we’ve got the expert advice and easy-to-use budget tricks that’ll help you stretch every dollar without sacrificing your lifestyle. Master these tips for stress-free financial future!

Save on Food Costs

- Grocery Lists: A well-thought-out shopping list keeps you on track at the store, helping to stick to your budget and resist those tempting impulse buys. Shopping smart has never been easier!

- Balanced Diet: A well-thought-out shopping list keeps you on track at the store, helping to stick to your budget and resist those tempting impulse buys. Shopping smart has never been easier!

- Meal Prep: Meal planning might save you from the last-minute dinner decision, which creates massive pressure for many of you. It also saves food from waste. A hattrick, both for your wallet and the environment!

5. Limit Eating Out

Learn how to save with our 10 must-do budgeting tips for students. This is a useful guide by financial experts who provide trustworthy and practical advice that will keep you on your financial path. So, start budgeting well today and ensure confidence about securing your financial future.

Control Dining Expenses

- Make Dining Out an Occasional Treat: Switch regular restaurant trips to home-cooked meals. Dine out when it is a special time as you will cherish those special moments even more.

- Cook in Bulk: Cook dinners in bulk and keep them, which means you get spare time and also money saved. Additionally, you will enjoy great in-home dinners anytime!

- Plan Your Meals: Plan your meals for the entire week to avoid buying food on impulse and wasting unnecessary food. Grocery shopping becomes that much easier, and your wallet remains happy!

6. Take Advantage of Discounts

Unlock Your Path to Financial Success as a Student by Using Our Trustworthy, Expert Budgeting Tips to Master Your Expenses Easily and Confidently Practical Advice Designed Especially for You-Start Today for That Worry-Free College Experience and Peace of Mind

Utilize Student Benefits

- Student Discounts: Being a student comes with tons of perks! Keep looking for fantastic discounts at restaurants, stores, and even some online services. Youd be surprised at how many places give deals just for students.

- Memberships: Get the most out of your status by creating special memberships. Be it Amazon Prime or software subscriptions, these deals make a difference in saving you loads of cash.

- Explore and Save: Unlock great deals just for students, and discover new places without spending money. From travel to tech, there is a whole world of saving waiting for you!

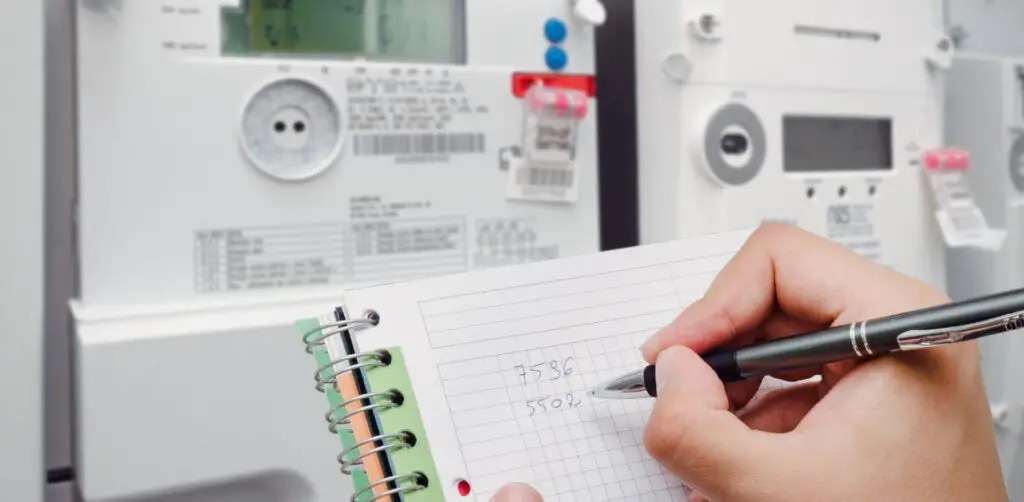

7. Monitor Utility Usage

Unlock the door to financial freedom with tips on budgeting for students. Acquire and develop money-saving skills and enjoy college without financial stress. Start your journey toward mastering your expenses today!

Manage Household Costs

- Be Energy Efficient: Turn off lights when you are not using them; unplug devices. Pick energy-saving devices for a greener house.

- Water Conservation: Reaping the benefit of showers that don’t run as long and nipping at those annoying leaks can greatly make a difference. Mostly, small changes equal huge savings on that water bill.

- Recycle and Reuse: Practice recycling each day, and reuse things creatively. Reduce, reuse, recycle is an easy way to cut down on waste and help save the planet!

8. Set Financial Goals

Welcome to your inside guide to student budgeting! Student finance specialists here share some trusted and simple suggestions we have to pass along to you in enabling you to better manage your funds. Take that first step toward peace of mind and have a stress-free college life!

Aim for Savings

- Short-Term Goals: Divide your savings into monthly targets. This enables you to set aside money for emergencies or to save up for something special.

- Long-Term Planning: would be about tuition to travel; therefore, have considerations in your budget, and you’ll have a stress-free future.

- Stay Flexible: Life happens. So, plan a budget that is flexible enough for any change that might come along. Flexibility will help you not be too worried about changes.

9. Review and Adjust Your Budget Regularly

Discover budgeting tips targeted to students to help you make the most of your money. Find your way to spending money at peace through college years. Our trusted guide empowers you to control your financial future with confidence.

Stay Flexible

- Regular Check-ins: Review your budget regularly. Keep watch on small changes in income and expense so that you do not lose control.

- Flexible Adjustments: If at some point, things do not go as planned, do not worry. You can easily maneuver another area of your budget to restore balance.

- Stay Organized: Have all your budget tools at hand and up to date. Whether it is an app, notebook, or any other tool, having everything on one sheet of paper helps in managing finance more easily and stress-free.

10. Avoid Impulse Purchases

Welcome to your ultimate college budget guide! Discover expert tips on saving money and minimizing stress that helps you really cut loose with your expenses. Begin mastering your finances today for a smooth ride in college!

Cultivate Mindful Spending Habits

- Wait Before Buying: Give yourself a 24-hour pause before throwing money on unnecessary items. That little wait can help you decide if it’s worth it or an impulse purchase.

- Limit Exposure: Less exposure to browsing online stores or mall trips can exclude you from that tempting deal. See the magic of lesser screen time leading to more saving and a few impulse buys.

- Set a Budget: This will help you keep track of spends and your savings. Little planning will magically lead you to big savings!

Conclusion

The effective management of money during college requires detailed budgeting on the needs first and then will later prioritize what is essential. Planning for meals and buying things on discounts will certainly add more to financial stability. Budget reviews have often returned students to their finances’ right and good path. Simple steps ensure fun college experiences without harming financial health.

FAQs

What are some practical ways to maximize a student’s income?

Get a part-time job, freelance, even sell some unused items. You can also opt for on-campus jobs and paid internships which can be flexible.

How can students effectively balance budgeting with enjoying college life?

Create a budget plan that is eyeing only essentials and balancing this with the provision for some leisure time.

What are the best budgeting tools specifically for students?

Few very good budgeting tools which a student would need to track his/her spendings, set savings goals, and efficiently manage finances include: Mint, YNAB, and PocketGuard.

How can students take advantage of scholarships throughout their college career?

Find scholarships frequently through school resources and online sources. Continue updating application materials and keep applying continuously in order to increase your chances.

What are some common mistakes students make with their budgets?

Mistakes include failing to track expenses, underestimation of the costs, and overspending on nonessentials. Make a budget plan and revise it constantly.

People also ask

What are the 7 steps in good budgeting?

Set clear financial goals.

Track your income and expenses.

Categorize your spending.

Create a realistic plan.

Allocate funds to savings.

Monitor and adjust as needed.

Review your budget regularly.

What are budgeting strategies for students?

Use apps to track the expenses, identify wants over needs, and place some limitation on the spending to stay within budget.

What are budgeting strategies for students research questionnaire?

These questions involve the sources of income, expenses, savings, and potential setbacks for a student’s finances.

How much should a college student save per month?

Save 20% of everything you bring home. Every dollar counts.

What is the 10 10 10 budget rule?

This approach is called the “50/30/20,” where you dedicate 10% for savings, 10% for investment, and 10% for debt repayment, leaving the remaining balance for expenditures.